The property market in the UK is a complex and multifaceted entity, characterised by a myriad of factors that influence property prices and values.

One of the critical metrics often underutilised to gauge the value of property is the price per square foot (£/sq.ft). This figure provides a standardised measure, enabling comparisons across different regions and localities.

In this article, we will delve into the £/sq.ft figures for the UK as a whole, the North East region (and how that compares to other regions), the Low Fell property market and why this £/sq.ft metric is particularly significant.

National Trends: The UK Perspective

Across the UK, property prices have seen significant fluctuations over the past three decades.

The £/sq.ft figure is a valuable alternative indicator of these house price changes (instead of the normal headline price). On average, the national £/sq.ft is a composite reflection of diverse property markets, from the bustling urban centres of London and Manchester to the serene rural areas of Scotland and Wales and takes into account other aspects of house values.

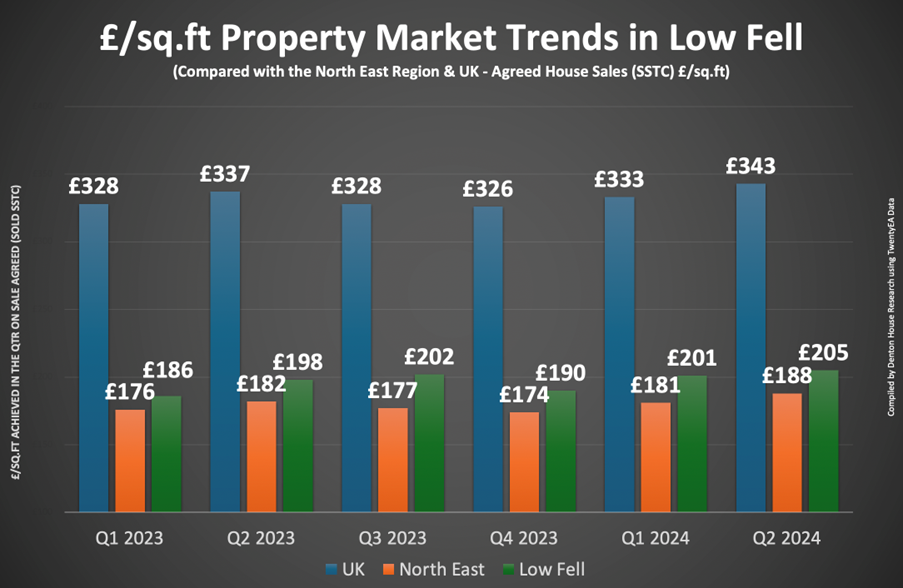

The average £/sq.ft on the UK homes sold

in Q2 2024 was £343/sq.ft

This is up from £328/sq.ft in Q1 2023, a rise of 4.61%.

This figure encapsulates the varying dynamics of the UK housing market, influenced by economic conditions, governmental policies, and demographic shifts. The highest £/sq.ft can be found in W1 (Mayfair, Marylebone, Fitzrovia, and Soho) up to the heady heights of £1,187/sq.ft. This is driven by high demand, overseas buyers and limited supply.

Conversely, rural northern areas exhibit lower figures, the lowest being in Shildon in County Durham (DL4) at £77/sq.ft, due to the local economy, geography, housing stock and differing lifestyle preferences.

Regional Focus: The North East

Let’s look closer to home, in our region.

The average £/sq.ft on the North East homes sold

in Q2 2024 was £188/sq.ft

This is up from £176/sq.ft in Q1 2023, a rise of 6.82%.

Our region has experienced steady growth in property prices, at a slightly faster pace compared to the national trend.

The North East has seen significant investment in infrastructure and development projects, bolstering its property market prospects. Also, the region's strong transport links, including major motorways and rail connections, enhance its appeal.

Before we look at the Low Fell numbers, let us compare all the regions for Q2 2024 (and their growth in £/sq.ft levels from Q1 2023).

• North East £188 sq.ft - a growth of 6.82%

• Scotland £213/sq.ft - a growth of 7.04%

• Wales £244/sq.ft - a growth of 5.17%

• Yorkshire and The Humber £247/sq.ft - a growth of 5.56%

• North West £253/sq.ft - a growth of 6.30%

• East Midlands £269/sq.ft - a growth of 2.67%

• West Midlands £286/sq.ft - a growth of 4.00%

• South West £357/sq.ft - a growth of 1.13%

• East of England £393/sq.ft - a growth of 1.03%

• South East £437/sq.ft - a growth of 1.39%

• Outer London £549 sq.ft - a growth of 1.48%

• Inner London £779/sq.ft - a growth of 3.04%

As you can see, the least expensive the region, the higher the growth in house prices (£/sq.ft).

Local Insight: Low Fell's Perspective

Zooming in further, let's examine the £/sq.ft figure for Low Fell (NE9).

The average £/sq.ft on the Low Fell homes sold

in Q2 2024 was £205/sq.ft

This is up from £186/sq.ft in Q1 2023, a rise of 10.22%.

This figure reflects the area's unique blend of factors influencing property prices. The presence of reputable schools and a vibrant community plays a significant role and enhances its attractiveness to homeowners (and landlords alike).

The area offers a balance between urban amenities and a suburban lifestyle, appealing to families and individuals seeking a quieter yet well-connected environment.

The local economy, supported by a mix of industries, also contributes to the property market. Low Fell's diverse employment base, coupled with ongoing development projects, fosters a stable demand for housing. Additionally, the area's cultural and recreational offerings, including leisure, shops, and entertainment venues, enhance its appeal to prospective buyers.

The Importance of £/sq.ft: A Deeper Look

The £/sq.ft figure is not just a statistic; it is a crucial indicator of the property market's health and trends. In a previous analysis, it was highlighted that this metric offers a more immediate reflection of the market compared to traditional indices such as the Land Registry or Nationwide House Price Index. These traditional indices lag six to nine months behind due to the time it takes to complete sales and register transactions.

The £/sq.ft measure allows for real-time tracking of property values, offering insights several months ahead of official reports.

For instance, if the £/sq.ft figures indicate an increase, it can be inferred that property prices are on an upward trend, even if official indices have not yet reflected this change. This real-time data is invaluable for buyers, sellers, and investors, enabling them to make informed decisions based on current market conditions rather than outdated information.

Therefore, by following the trend of £/sq.ft figures, we can see house price trends six to nine months ahead of official figures. This gives you the ability to judge the top, bottom and general trends of the property market, therefore giving you, the reader, an advantage into the Low Fell property market.

Final Thoughts: The Interconnected Dynamics of the National, Regional and Local Low Fell Property Markets

In summary, the £/sq.ft figures for the UK, the North East, and Low Fell illustrate the interconnected dynamics of the property market.

Understanding these £/sq.ft figures provides valuable insights for potential buyers, investors, and policymakers. It underscores the importance of considering both macro and micro factors when navigating the property market. As the market continues to evolve, staying informed about these metrics will be crucial for making well-informed decisions in the ever-changing landscape of UK property.

If you would like more information about the Low Fell property market and where it sits both regionally and nationally, then please do follow us on social media, where we post lots of information which will help and guide you on your property journey in the area.

Report a Maintenance Issue

Report a Maintenance Issue